what triggers net investment income tax

What Triggers Net Investment Income Tax. NII is generated from dividends capital gains.

How To Complete Irs Form 8960 Net Investment Income Tax Of 3 8 Youtube

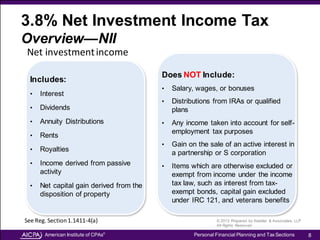

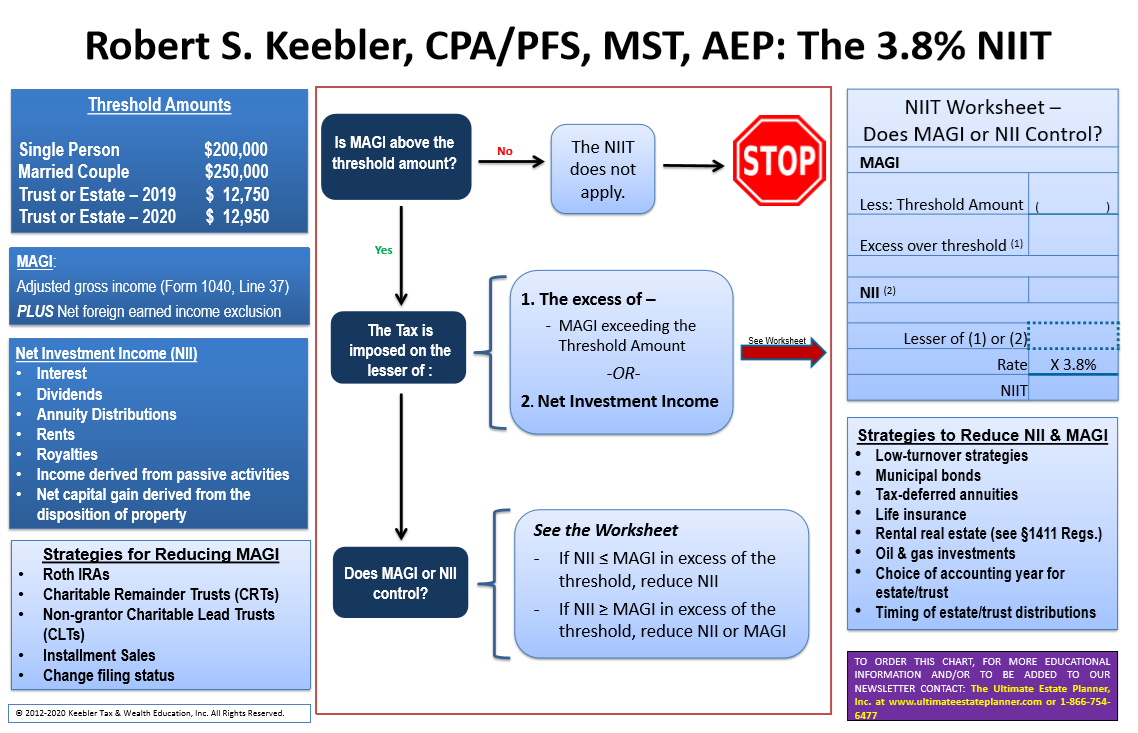

The net income investment tax NIIT is a 38 tax applied to rental property income and capital gains once certain income thresholds are met depending on your filing status.

. Lets say you have 30000 in net investment income and your MAGI goes over the threshold by 50000. In general net investment income for purpose of this tax includes but isnt limited to. The following example goes.

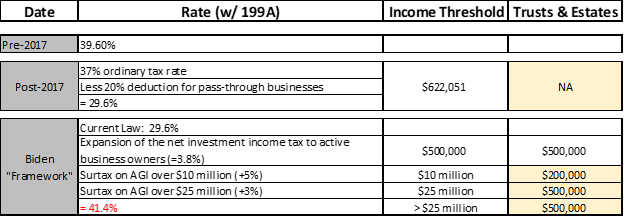

The net investment income tax is a 38 surtax that is paid in addition to regular income taxes. Individuals who pay net investment income tax also pay capital. The Net Investment Income Tax is an added tax that is charged on dividends interest and capital gains from your investments.

What Triggers Net Investment Income Tax. Net investment income NII is the total income before taxes that an investor receives on their portfolio of investment assets. For the purposes of the NIIT investment income includes the following.

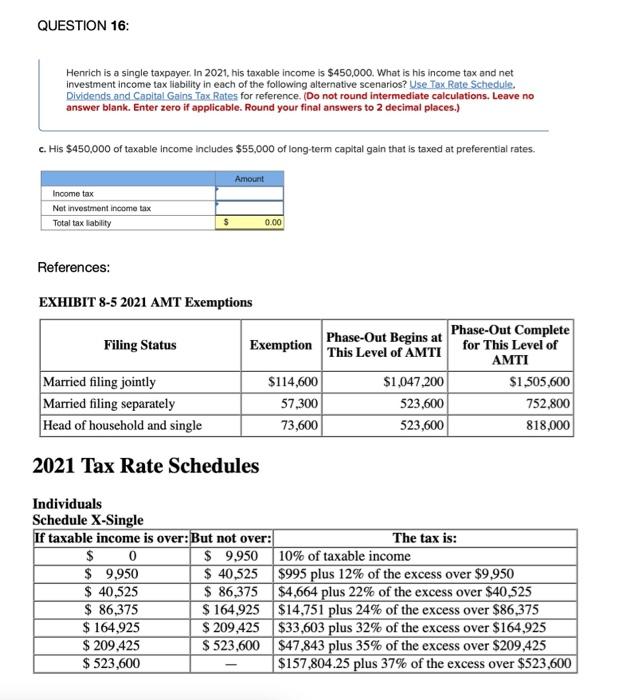

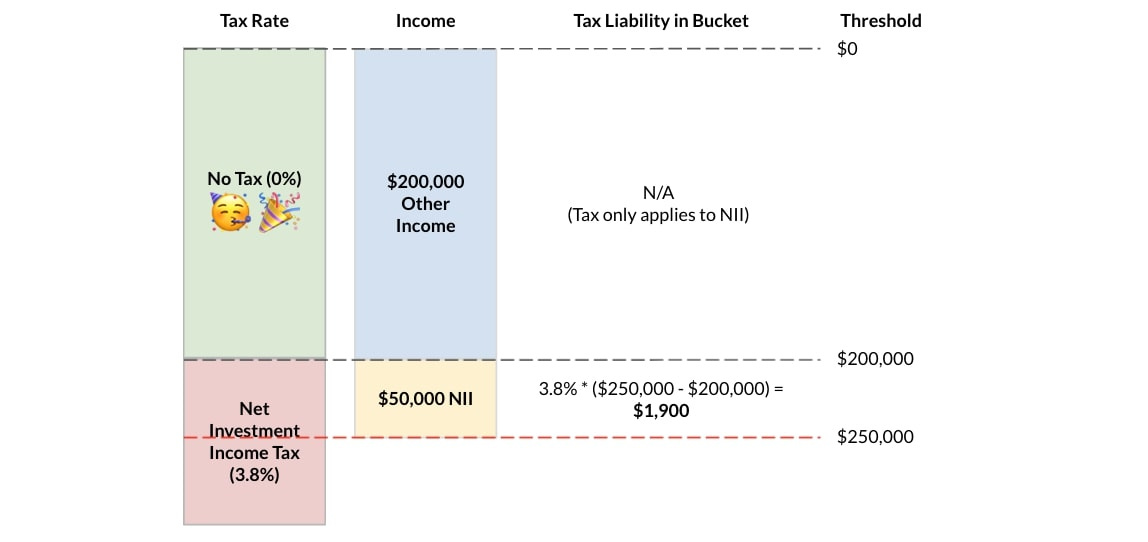

Their net investment income or the amount by which their. The net investment income tax is due on the lesser of your undistributed net investment income or the portion of your MAGI that exceeds the thresholds. The Net Investment Income Tax is based on the lesser of 70000 the amount that Taxpayers modified adjusted gross income exceeds the.

Definition of Net Investment Income and Modified Adjusted Gross Income. It can also apply to many other forms of income such as rental. The tax explained.

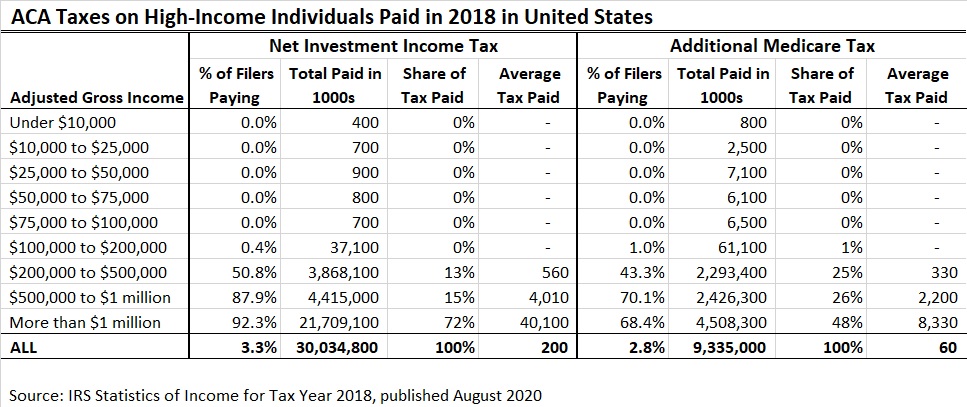

Net investment income tax is an additional tax that applies to high-earning individuals who owe capital gains tax. The net investment income tax NIIT is a 38-percent tax on the smaller of your net investment income or the amount that your modified adjusted gross. You may owe a 38 net investment income tax if your modified adjusted gross income is over 200000 for single filers.

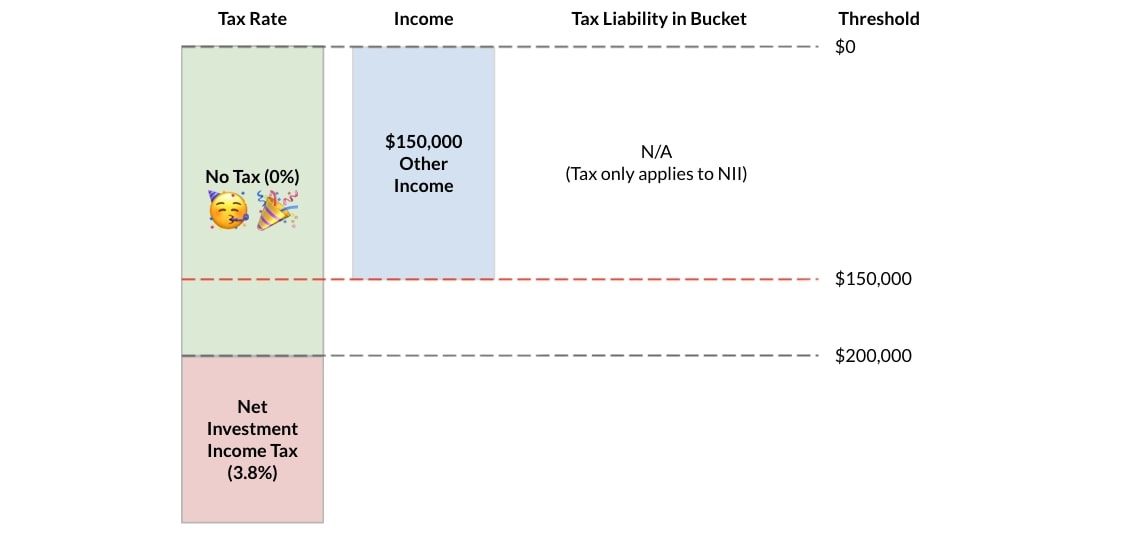

Those who are subject to the tax will pay 38 percent on the lesser of the two. You had over 200000 of income. Try to keep our modified adjusted gross income below the statutory threshold so we are not subject to the 38 Net Investment Income Tax.

NIIT is a tax on net investment income. What is net investment income. Taxpayers Net Investment Income is 90000.

In the case of individual taxpayers section 1411a1 of the tax code imposes a tax in addition to any other tax imposed by. We mentioned that NIIT is conditional. That triggers the NIIT on 25000 of the 35000 in rental income for an additional tax of 950 25000 x 0038.

But not everyone who makes income from their investments is impacted. The net investment income tax is due on the lesser of your undistributed net investment income or the portion of your MAGI that. If you earn over 200000 per year you may be subject to the net investment income tax NIIT an additional tax levied on the investment income of taxpayers considered to be.

Avoid increasing taxable income when. But youll only owe it on the 30000 of investment income. Youll owe the 38 tax.

What Is The Net Investment Income Tax Best Wallet Hacks

Assault On Family Businesses Continues The S Corporation Association

How To Calculate The Net Investment Income Properly

T22 0013 Application Of Niit To Trade Or Business Income Of Certain High Income Individuals In H R 5376 By Expanded Cash Income Level 2023 Tax Policy Center

Understanding The Net Investment Income Tax Calculation And Examples Thinkadvisor

Planning For The Parallel Universe Of The Net Investment Income Tax

Avoiding The 3 8 Net Investment Income Tax Tan Wealth Management Certified Financial Planner Cfp San Francisco Advisor

Four Things To Know About Net Investment Income Tax Htj Tax

Solved Question 16 Henrich Is A Single Taxpayer In 2021 Chegg Com

What Is The Net Investment Income Tax Williams Cpa Associates

Understanding The Net Investment Income Tax

Net Investment Income Tax For 1040 Filers Perkins Co

Net Investment Income Tax By Allen Osgood Wealthjoy

2022 Applying The 3 8 Net Investment Income Tax Chart Ultimate Estate Planner

What Is The The Net Investment Income Tax Niit Forbes Advisor

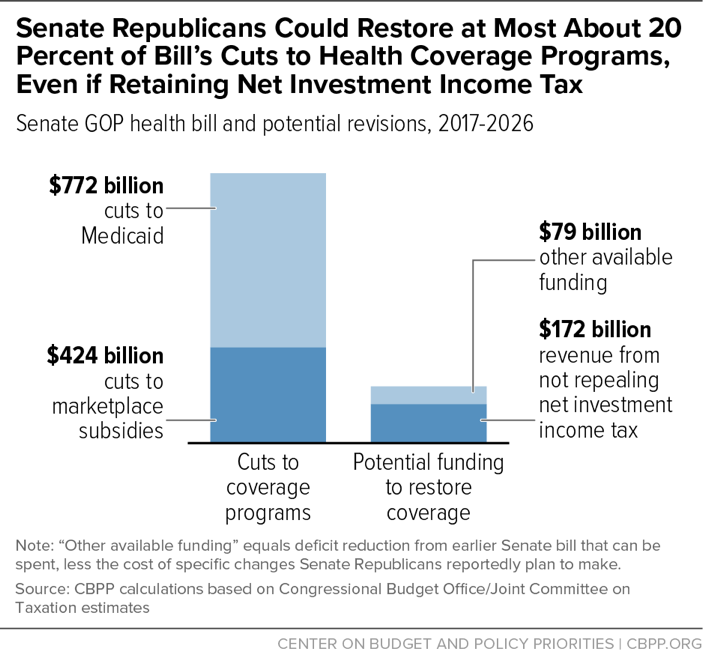

Senate Republicans Could Restore At Most About 20 Percent Of Bill S Cuts To Health Coverage Programs Even If Retaining Net Investment Income Tax Center On Budget And Policy Priorities

Net Investment Income Tax By Allen Osgood Wealthjoy

How Are Capital Gains Taxed Tax Policy Center

Secure Act S Increase In Rmd To Age 72 May Lead To Avoidance Of Net Investment Income Tax Hall Benefits Law